The financial sector in Bangladesh plays a critical role in the nation’s economy, providing essential services such as banking, insurance, and investment management. As the industry faces growing demands for transparency, security, and efficiency, ISO certification emerges as a crucial tool for financial institutions to meet these challenges. ISO standards provide globally recognized benchmarks that help institutions enhance their operational efficiency, secure customer trust, and comply with regulatory requirements. In this blog, we will explore the importance of ISO certification for financial institutions in Bangladesh, the relevant ISO standards, the benefits they offer, and how you can start your certification journey with B-ADVANCY Certification Limited.

What is ISO Certification and Why is it Important for Financial Institutions?

ISO certification is a formal recognition from the International Organization for Standardization (ISO) that an organization adheres to one of its internationally recognized management system standards. For financial institutions, ISO certification is essential for demonstrating a commitment to quality, security, and operational excellence—factors that are crucial in gaining and maintaining the trust of customers, regulators, and investors.

In Bangladesh, the financial sector encompasses a wide range of activities, including banking, insurance, asset management, and fintech services. By adhering to ISO standards, financial institutions can ensure the consistent delivery of high-quality services, improve their risk management processes, and enhance their overall operational efficiency. Additionally, ISO certification can help institutions meet both local and international regulatory requirements, which is increasingly important in a globally interconnected financial system.

Key ISO Standards for Financial Institutions

Several ISO standards are particularly relevant for financial institutions in Bangladesh:

ISO 9001:2015 - Quality Management Systems

ISO 9001:2015 provides a framework for developing a robust quality management system (QMS) that ensures consistent service delivery. For financial institutions, this standard helps in improving customer satisfaction, reducing errors, and enhancing process efficiency.

ISO/IEC 27001:2022 - Information Security Management Systems

In the financial sector, information security is paramount. ISO/IEC 27001:2022 provides a systematic approach to managing sensitive company information, ensuring data security, and protecting against cyber threats. This standard is crucial for safeguarding customer data and maintaining regulatory compliance.

ISO 22301:2019 - Business Continuity Management Systems

ISO 22301:2019 helps financial institutions prepare for, respond to, and recover from disruptive incidents, such as cyberattacks or natural disasters. This standard ensures that institutions can continue critical operations during crises, minimizing disruptions and protecting their reputation.

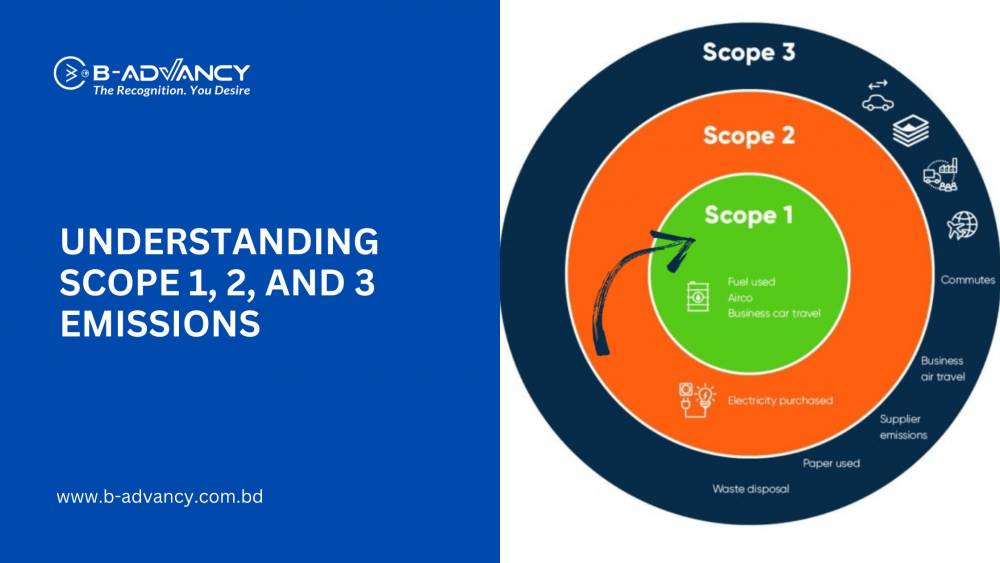

ISO 31000:2018 - Risk Management

Risk management is integral to the financial sector. ISO 31000:2018 offers a framework for identifying, analyzing, and managing risks that could impact business objectives. This standard helps financial institutions mitigate risks related to operations, finance, compliance, and reputation.

ISO 14001:2015 - Environmental Management Systems

Although primarily associated with environmental impact, ISO 14001:2015 is increasingly relevant for financial institutions as they adopt sustainable practices. This standard helps organizations manage their environmental responsibilities, contributing to corporate social responsibility (CSR) initiatives.

Benefits of ISO Certification for Financial Institutions in Bangladesh

Enhanced Service Quality and Customer Trust

ISO certification ensures that financial institutions consistently deliver high-quality services, which enhances customer trust and satisfaction. This leads to stronger client relationships and a more positive reputation in the market.

Improved Information Security

By implementing ISO/IEC 27001, financial institutions can better protect sensitive data, reduce the risk of cyberattacks, and ensure compliance with data protection regulations. This is particularly important in a sector where data breaches can have severe consequences.

Stronger Compliance and Risk Management

ISO standards provide a structured approach to managing regulatory compliance and business risks. This reduces the likelihood of legal issues, financial losses, and operational disruptions.

Operational Efficiency and Cost Reduction

Adopting ISO standards helps financial institutions streamline their processes, reduce inefficiencies, and optimize resource usage. This can lead to significant cost savings and improved profitability.

Facilitation of International Trade and Partnerships

ISO certification aligns financial institutions with global standards, making it easier to establish partnerships with international firms and expand into global markets.

Steps to Achieve ISO Certification for Your Financial Institution

Achieving ISO certification involves several critical steps:

Initial Assessment and Gap Analysis

Begin by evaluating your current processes against the requirements of the relevant ISO standard. Identify gaps and areas that need improvement to meet the certification criteria.

Develop and Implement a Management System

Design and implement a management system that complies with the chosen ISO standard. This may involve documenting processes, setting objectives, and training employees on new procedures.

Internal Audit and Management Review

Conduct internal audits to ensure your management system is effective and compliant. Regular management reviews are essential to address any issues and drive continuous improvement.

Select a Certification Body

Choose a reputable certification body, such as B-ADVANCY Certification Limited, to conduct an external audit. Prepare thoroughly for this audit to demonstrate compliance with the ISO standard.

Achieve Certification and Commit to Ongoing Improvement

After a successful audit, you will receive ISO certification. It’s important to maintain and improve your management system to retain certification and continue benefiting from it.

Challenges in Implementing ISO Standards

While ISO certification offers numerous advantages, implementing these standards can pose challenges, including:

Resistance to Change

Employees may resist changes to established processes, especially in long-standing financial institutions. Effective communication and training are crucial to help staff understand the benefits of ISO certification.

Cost and Resource Allocation

The costs associated with certification, including consulting, training, and auditing, can be significant. However, the long-term benefits of ISO certification, such as improved efficiency and marketability, often justify these initial expenses.

Documentation and Process Management

Maintaining comprehensive documentation can be time-consuming but is essential for successful certification. A well-organized documentation system is key to demonstrating compliance during audits.

B-ADVANCY Certification Limited can guide you through these challenges with expert support, making the certification process more manageable and efficient. To contact them: Email: bangladesh@b-advancy.com | Call: +8801612264559

Relevant Authorities and References in Bangladesh

For financial institutions in Bangladesh, several regulatory bodies oversee compliance and operational standards. Below are some key authorities and resources:

-

Bangladesh Bank: The central bank of Bangladesh, responsible for regulating and supervising the banking sector. For guidelines and regulations, visit Bangladesh Bank.

-

Bangladesh Securities and Exchange Commission (BSEC): Regulates the capital markets, ensuring transparency and protecting investors. For more information, visit BSEC.

-

Microcredit Regulatory Authority (MRA): Regulates microfinance institutions in Bangladesh. For guidelines and updates, visit MRA.

-

Insurance Development and Regulatory Authority (IDRA): Oversees the insurance industry in Bangladesh. For standards and regulations, visit IDRA.

Conclusion

ISO certification is not just a credential for financial institutions in Bangladesh; it is a strategic investment that can significantly enhance service quality, operational efficiency, and market competitiveness. By aligning your processes with internationally recognized standards, your institution can achieve consistent service delivery, improve customer trust, and gain a competitive edge in both local and global markets. While the certification journey may present some challenges, the long-term benefits far outweigh the initial efforts.