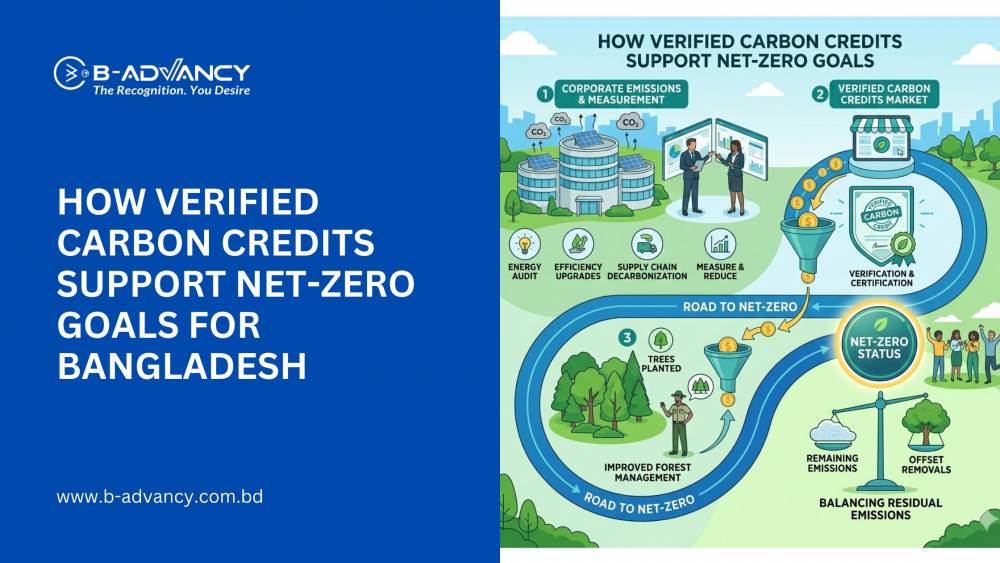

As the world accelerates its transition toward a low-carbon economy, carbon credit certification has become a critical mechanism for countries like Bangladesh to align with global sustainability goals. With increasing international pressure, corporate responsibility mandates, and environmental regulations, Bangladeshi industries are now exploring the benefits and opportunities that carbon credit certification can bring.

This blog explains what carbon credits are, why they matter in Bangladesh, and how businesses can get certified to participate in the global carbon market.

What Are Carbon Credits?

Carbon credits are permits that allow the holder to emit a certain amount of carbon dioxide or other greenhouse gases. One carbon credit equals one metric ton of CO₂-equivalent emissions. Companies or projects that reduce or capture carbon emissions (e.g., through renewable energy, reforestation, or improved energy efficiency) can generate carbon credits and sell them to businesses looking to offset their carbon footprint.

There are two main markets for carbon credits:

-

Compliance Market: Where companies are legally required to offset emissions (e.g., EU ETS).

-

Voluntary Market: Where companies offset emissions voluntarily to meet ESG goals or demonstrate corporate responsibility.

Why Bangladesh Needs Carbon Credit Certification

Bangladesh is highly vulnerable to climate change impacts, such as rising sea levels, flooding, and erratic weather patterns. At the same time, the country is rapidly industrializing and expanding its energy infrastructure. This presents both a risk and an opportunity.

By establishing a carbon credit certification ecosystem, Bangladesh can:

-

Attract foreign investment in clean energy, waste management, and reforestation projects.

-

Help industries generate revenue by selling carbon credits in global markets.

-

Contribute to climate mitigation while advancing its own Nationally Determined Contributions (NDCs) under the Paris Agreement.

-

Promote green branding and sustainable development in textile, energy, agriculture, and manufacturing sectors.

Industries That Can Benefit from Carbon Credit Certification

Several sectors in Bangladesh are ideal candidates for carbon credit certification:

-

Renewable Energy Projects: Solar, wind, and biogas plants.

-

Textile and Garment: Energy efficiency and waste heat recovery.

-

Waste Management: Methane recovery from landfills, composting.

-

Agriculture: Improved rice cultivation, carbon sequestration through agroforestry.

-

Transport and Logistics: Shift to EVs and fuel efficiency upgrades.

-

Construction and Real Estate: Green building certifications and energy-saving measures.

How Carbon Credit Certification Works

To participate in the carbon market, businesses must go through a recognized certification process. Here’s a step-by-step guide:

1. Project Identification

Determine if your process or activity leads to a measurable reduction in greenhouse gas emissions.

2. Baseline Assessment

Conduct a baseline study to measure current emission levels without the project.

3. Documentation & Methodology

Develop a Project Design Document (PDD) following internationally accepted methodologies such as Gold Standard, Verified Carbon Standard (VCS), or Clean Development Mechanism (CDM).

4. Validation & Verification

A third-party verifier (e.g., TÜV SÜD, SGS, DNV) assesses the project to ensure it meets carbon credit standards and emission reduction claims.

5. Registration & Issuance

Upon successful validation, the project is registered, and carbon credits are issued based on verified emission reductions.

6. Trading

Credits can be traded in global markets or used internally for compliance or corporate offsetting.

Carbon Credit Standards Recognized in Bangladesh

Bangladesh does not currently operate its own national carbon trading platform but supports international standards such as:

-

Gold Standard (backed by WWF)

-

Verra’s Verified Carbon Standard (VCS)

-

CDM (Clean Development Mechanism) under UNFCCC

-

ISO 14064 for GHG quantification and verification

As of now, many local projects (especially in renewable energy and waste management) have been registered under international programs, positioning Bangladesh as an emerging participant in the global carbon market.

Role of Government and Policy Support

The Department of Environment (DoE) and Ministry of Environment, Forest and Climate Change (MoEFCC) are key players in Bangladesh’s climate initiatives. While Bangladesh is working on developing a carbon market policy framework, it is already aligned with carbon trading and NDC fulfillment goals.

Policies like the Bangladesh Climate Change Strategy and Action Plan (BCCSAP) and support from international donors are setting the stage for more structured participation in the carbon economy.

Benefits of Carbon Credit Certification

-

Monetization of Emission Reductions: Earn revenue by selling carbon credits.

-

Brand Reputation: Gain credibility with environmentally conscious consumers and investors.

-

ESG Compliance: Meet Environmental, Social, and Governance expectations globally.

-

International Collaboration: Join climate financing and technology transfer initiatives.

-

Regulatory Preparedness: Be ready for future carbon tax or emission trading laws.

Challenges in the Bangladeshi Context

-

Limited awareness among SMEs and even large corporations.

-

Upfront cost of project validation and certification.

-

Lack of local expertise in carbon accounting and MRV (Monitoring, Reporting, Verification).

-

No local carbon exchange or carbon credit registry (yet).

These challenges, however, are opportunities for consultants, certification bodies, and green investors to build capacity and infrastructure.

📲 Contact B-ADVANCY Today for Support

👉 WhatsApp: https://wa.me/+8801612264559

🌐 Website: www.b-advancy.com.bd

Learn from certified professionals and build a future-ready.

Conclusion

Carbon credit certification in Bangladesh is no longer a futuristic concept—it’s a viable tool for sustainability, profitability, and global integration. From energy-efficient factories to climate-smart agriculture and green buildings, the potential is vast. With proper guidance, international standards, and government support, Bangladeshi businesses can not only reduce their environmental footprint but also tap into the lucrative carbon credit market.

Now is the time for forward-thinking companies to embrace this green opportunity and position themselves as leaders in Bangladesh’s low-carbon transition.