As global climate challenges continue to intensify, carbon credits and emissions trading have emerged as powerful mechanisms to reduce greenhouse gas emissions and promote sustainable development. Bangladesh, being both climate-vulnerable and rapidly developing, is now gaining importance in the global carbon market. With increasing interest in renewable energy, waste management, forestry, and industrial efficiency projects, the demand for verified carbon credits and professional carbon trading support is growing steadily.

To participate successfully in this evolving market, organizations require expert consulting and assessment services that ensure compliance, transparency, and global acceptance of their carbon reduction initiatives.

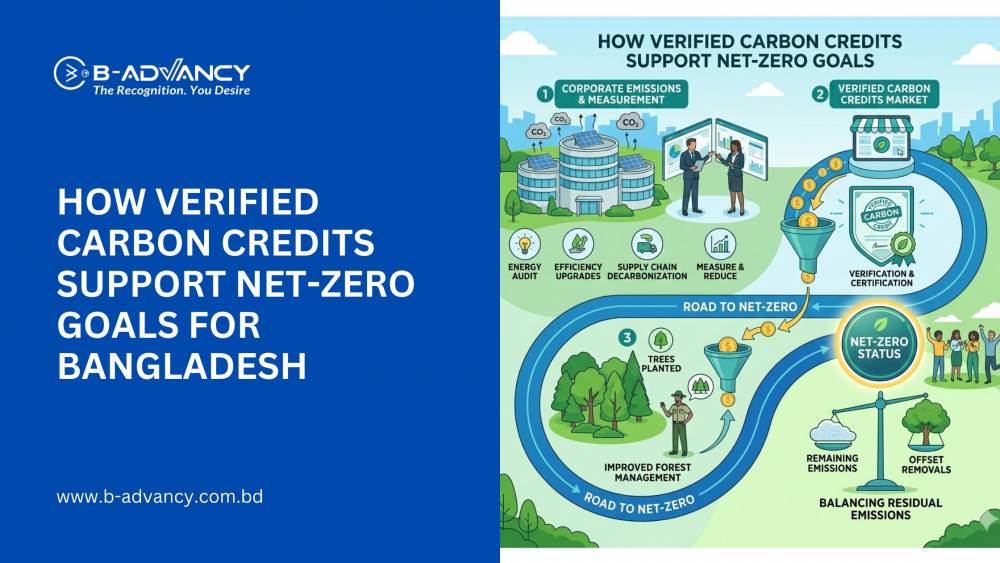

How Verified Carbon Credits Help Fight Climate Change

A verified carbon credit represents the certified reduction or removal of one metric ton of carbon dioxide or its equivalent in other greenhouse gases. These credits are independently audited and issued under internationally recognized standards such as Verra’s Verified Carbon Standard (VCS), Gold Standard, Clean Development Mechanism (CDM), ISO 14064, Plan Vivo, and the American Carbon Registry.

Such verification ensures that emission reductions are real, measurable, additional, and permanent. Verified carbon credits can be traded in voluntary carbon markets or used by organizations to offset emissions and meet ESG and sustainability commitments.

Importance of Carbon Credit Consulting in Bangladesh

Bangladesh holds strong potential for carbon credit development due to its expanding renewable energy sector, increasing energy efficiency programs, reforestation and mangrove conservation initiatives, waste-to-energy projects, clean cooking solutions, and industrial optimization efforts.

However, developing a carbon credit project requires specialized technical knowledge, complex documentation, reliable monitoring systems, and coordination with international verification bodies. Without professional guidance, projects risk delays, rejection, or reduced credit value. This is why carbon credit consulting and assessment services are essential for Bangladeshi businesses, NGOs, and development organizations seeking entry into the carbon market.

Carbon Footprint Assessment Services

Carbon footprint assessment is the foundation of any carbon credit or offset initiative. Under ISO 14064-1 guidelines, organizations must quantify their greenhouse gas emissions across Scope 1, Scope 2, and Scope 3 categories. This involves structured data collection, emissions factor selection, baseline calculation, and internal validation.

Accurate carbon footprint assessments not only support credit development but also help organizations understand emission hotspots and prioritize reduction strategies.

Carbon Credit Project Feasibility Studies

Before registering a carbon credit project, it is critical to evaluate technical, financial, and regulatory feasibility. This includes identifying eligible project types, assessing additionality and permanence, estimating emission reduction potential, and analyzing project risks such as leakage and operational uncertainty.

A professional feasibility study also includes preliminary revenue forecasting from carbon trading and market demand analysis, helping project developers make informed investment decisions.

Methodology Selection and Project Documentation

Each carbon credit project must follow an approved methodology under standards such as VCS, Gold Standard, CDM, or ISO 14064-2. Selecting the correct methodology is essential to ensure eligibility and maximize credit issuance.

Consultants prepare detailed Project Design Documents (PDDs), monitoring plans, and stakeholder engagement records. These documents describe project boundaries, baseline scenarios, emission calculations, monitoring procedures, and social and environmental safeguards.

Monitoring, Reporting, and Verification Support

Monitoring, Reporting, and Verification (MRV) ensures that actual emission reductions match projected outcomes. Consultants design monitoring systems, define key performance indicators, and establish data quality controls.

They also support verification readiness audits and coordinate with accredited third-party verifiers. Proper MRV implementation significantly reduces the risk of non-conformities and delays during verification.

Carbon Credit Registration and Issuance

Once a project is validated and verified, it must be registered with an approved international registry. Consultants manage registry applications, verification coordination, and credit issuance processes.

They also support registry account setup and transaction readiness to ensure smooth issuance and ownership transfer of verified carbon credits.

Carbon Trading Advisory Services

Carbon trading advisory services help organizations monetize their verified carbon credits effectively. This includes market entry strategy development, pricing and valuation guidance, buyer identification, contract negotiation support, and long-term trading planning.

With growing interest in voluntary carbon markets, professional advisory services ensure better pricing outcomes and reduced commercial risks.

Benefits for Bangladeshi Organizations

Carbon credit consulting and assessment services unlock new revenue opportunities while strengthening ESG and sustainability performance. Organizations gain international credibility, investor confidence, and compliance with global climate frameworks.

Participation in carbon markets also contributes to Bangladesh’s national climate commitments and promotes long-term environmental responsibility.

Industry Applications in Bangladesh

Industries that benefit from carbon credit services include renewable energy, garments and textiles, cement and manufacturing, agriculture and forestry, waste management, real estate, logistics, and development NGOs.

Each of these sectors has strong potential to generate verified emission reductions through structured sustainability initiatives.

Why Professional Carbon Credit Consultants Matter

Experienced carbon credit consultants ensure accurate emissions accounting, regulatory compliance, faster project registration, and higher credit market value. They also reduce the risk of project rejection and improve coordination with international standards bodies and registries.

Professional support significantly enhances the long-term viability and profitability of carbon credit projects.

The Future of Carbon Trading in Bangladesh

With rising international climate finance, ESG investments, and decarbonization pressure, Bangladesh is expected to become an important contributor to the voluntary carbon market. Early adoption of carbon credit projects will provide competitive advantage, financial returns, and sustainability leadership.

Conclusion

Consulting and assessment services for verified carbon credits and carbon trading in Bangladesh are becoming increasingly essential for organizations aiming to participate in the global climate economy. From carbon footprint assessment and feasibility studies to project validation, verification, and trading advisory, professional consulting ensures transparency, compliance, and profitability.

By investing in carbon credit development today, Bangladeshi businesses and institutions can unlock new revenue streams while contributing to a greener, more resilient future.

21.jpg)